Pocket Option has gained significant popularity among traders looking for flexible trading options in the binary options market. However, as with any trading platform, a crucial question arises: is Pocket Option a regulated broker? In this article, we will delve into the regulatory framework surrounding Pocket Option and discuss its implications for traders. Additionally, you can learn more about is pocket option a regulated broker торговля на Pocket Option for an informed trading experience.

Understanding Regulation in the Financial Markets

Before determining whether Pocket Option is regulated, it is essential to understand what regulation means in the context of financial markets. Regulation typically refers to the licensing and oversight provided by governmental agencies or independent regulatory bodies that ensure financial markets operate fairly and transparently. These bodies establish rules that protect investors and maintain the integrity of the market.

In the world of online trading, the presence of regulation is often seen as a badge of safety. A regulated broker is generally expected to follow specific standards, which can include maintaining capital adequacy, providing transparency in transactions, and offering some form of investor protection. Hence, for traders, a broker’s regulatory status can influence their decision to engage with that broker.

The Regulatory Status of Pocket Option

Pocket Option operates under the company name Gembell Limited, which is registered in the Commonwealth of Dominica. As of now, it is important to note that Pocket Option is not regulated by any major regulatory authority such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. The absence of major regulatory oversight raises concerns about the platform’s legitimacy and the safety of its users’ funds.

While Pocket Option does hold a license from the International Financial Market Relations Regulation Center (IFMRRC), this organization is not recognized as a stringent regulatory body like those mentioned previously. The license from IFMRRC does provide some assurance, but it may not carry the same weight in terms of investor protection.

The Implications of Being Unregulated

The lack of robust oversight can have several implications for traders using Pocket Option. First and foremost, it means that there may be limited recourse for users in case of disputes or financial issues. Additionally, unregulated brokers can sometimes operate with less transparency, making it harder for traders to trust the fairness of the trading conditions.

Another critical aspect is the level of customer service provided. Regulated brokers often have to adhere to higher standards concerning customer service and operational procedures. In contrast, unregulated platforms like Pocket Option may not have the same pressure to maintain high service levels.

Trading Conditions on Pocket Option

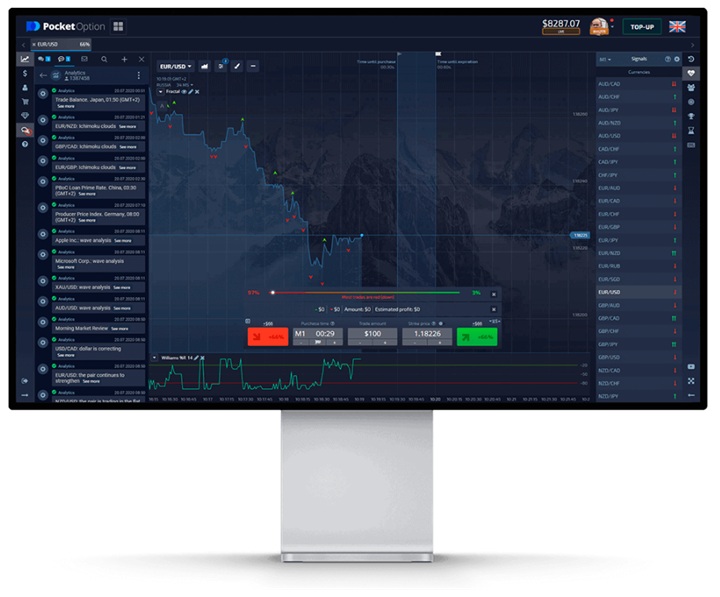

Despite the concerns regarding regulation, Pocket Option offers several features that appeal to traders—especially beginners. The platform provides a user-friendly interface, competitive trading conditions, and a variety of assets to choose from.

Among the trading features, users can benefit from a demo account, which allows them to practice trading without risking real money. This is particularly beneficial for those new to binary options trading, as it gives them a chance to familiarize themselves with the platform and its tools.

Pocket Option also boasts a range of payment methods, including cryptocurrencies, which enables traders to deposit and withdraw funds conveniently. However, traders should always meticulously review the withdrawal and deposit policies, as these practices can vary significantly among brokers, especially unregulated ones.

Risk Management and Compliance

Given that Pocket Option operates without the stringent oversight of major regulatory bodies, it is essential for traders to adopt a good risk management strategy. This includes understanding the risks associated with binary options trading, diversifying their trading portfolio, and only investing funds that they can afford to lose.

Traders should also remain vigilant for signs of potential issues. If a trading platform becomes overly aggressive in its marketing or begins to exhibit signs of unreliability, it may be time to reconsider engagement with that broker. Staying informed about industry news and trader experiences can help identify any red flags.

Pros and Cons of Using Pocket Option

Pros

- User-friendly trading platform suitable for beginners.

- Demo account available for practice.

- Wide range of assets for trading.

- Multiple payment methods, including cryptocurrencies.

Cons

- Lack of regulation from major financial authorities.

- Potential issues with customer service and complaints resolution.

- Limited investor protection mechanisms.

Conclusion

In conclusion, while Pocket Option provides various attractive features for traders, its lack of regulation from reputable authorities raises significant concerns. Traders considering using Pocket Option should weigh the potential benefits against the inherent risks associated with trading on an unregulated platform.

Ultimately, whether to trade on Pocket Option depends on the individual trader’s risk tolerance and investment goals. It is always advisable to conduct thorough research, keep up-to-date with the latest information, and consider alternatives that may offer stronger regulatory oversight and investor protection.