Pocket Option Robot Strategy: Expertise in Automated Trading

In the world of online trading, automation has become a game changer, especially when using pocket option robot strategy Pocket Option платформа для трейдинга. Traders are always looking for ways to enhance their efficiency and outcomes, and that’s where trading robots come into play. In this article, we will explore various strategies for using pocket option robot tools effectively, boosting your trading experience.

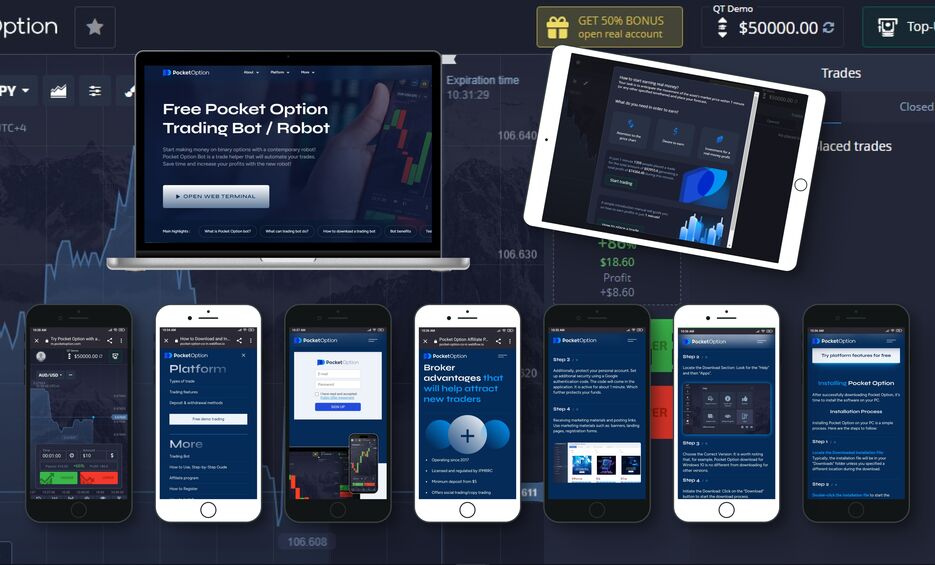

Understanding Pocket Option and Trading Robots

Pocket Option is a trading platform known for its user-friendly interface and diverse trading options. One of the unique features that attract traders is the ability to utilize automated trading robots. These programs are designed to analyze market trends, execute trades, and manage your trading portfolio without constant human supervision. However, just having a robot is not enough; implementing the right strategy is key.

Key Features of Pocket Option Trading Robots

Before diving into strategies, it’s essential to understand the benefits of Pocket Option robots:

- 24/7 Trading: Robots can analyze and trade even when you are not actively monitoring the markets.

- Emotion-Free Trading: Trading robots operate based purely on data, removing emotional decision-making that often leads to losses.

- Backtesting Capabilities: Many robots allow you to backtest trading strategies against historical data, enabling you to refine your approach.

Popular Strategies for Using Pocket Option Robots

Now that you understand the features, let’s look at some strategic approaches to maximize your trading results with Pocket Option robots.

1. Trend Following Strategy

One of the simplest yet effective strategies involves following market trends. Pocket Option robots can be programmed to identify when an asset is trending up or down and execute trades in the direction of that trend. This strategy is particularly useful in volatile markets where trends can lead to significant profit opportunities.

2. Arbitrage Trading

Arbitrage involves taking advantage of price differences for the same asset on different platforms. If your Pocket Option robot can swiftly execute trades on various exchanges, this can be a lucrative strategy. Setting the right parameters and ensuring your robot has access to multiple exchanges can provide profitable trading scenarios.

3. Scalping Strategy

Scalping is a strategy focused on making quick profits from minimal price changes. A pocket option robot can be programmed to execute a high volume of trades within a short time frame, accumulating small profits that can lead to significant earnings over time. This strategy requires precise timing and a well-calibrated robot.

4. News Trading

Leveraging news events can be advantageous in trading. Pocket Option robots can be programmed to respond quickly to market news and events that cause price volatility. This allows traders to capitalize on sudden price movements resulting from economic releases or geopolitical events.

5. Using Technical Indicators

Technical analysis is pivotal in trading decisions. Pocket Option robots can utilize various technical indicators, such as moving averages and RSI (Relative Strength Index), to determine trends and potential entry and exit points. Fine-tuning the robot’s algorithm to respond to these indicators will enhance trading accuracy.

Setting Up Your Trading Robot

Implementing a pocket option robot strategy involves several steps:

- Choose a Reliable Robot: Ensure that the robot you select is reputed and has positive reviews from users.

- Define Your Trading Goals: Before setting up your robot, define what you want to achieve. This includes your risk tolerance and desired return on investment.

- Customize the Settings: Depending on the strategy you choose, customize the robot settings. This could involve adjusting parameters, selecting the appropriate indicators, and defining risk management strategies.

- Backtest the Strategy: Utilize the backtesting feature to see how your robot would have performed based on historical data. This step is crucial for spotting potential issues in your strategy.

- Monitor Performance: Even with automation, keep an eye on your robot’s performance. Make adjustments as necessary and stay informed about market changes that could affect your strategy.

Common Mistakes to Avoid

While trading robots can improve performance, improper use can lead to losses. Here are common pitfalls to avoid:

- Over-optimizing: Continuous tweaking can lead to «curve fitting,» where the robot performs well on past data but fails in live market conditions.

- Ignoring Market Conditions: Economic changes and market volatility can significantly impact trading outcomes. Always stay updated with market news.

- Neglecting Risk Management: Failing to implement risk management protocols can lead to significant losses. Set stop-loss limits and diversify your trades.

The Future of Automated Trading

The landscape of online trading is continually evolving, with automation playing an increasingly vital role. As technology advances, so do the capabilities of trading robots. In the future, we can expect more sophisticated algorithms capable of understanding complex market dynamics, making them even more effective in executing strategies like the ones discussed.

Conclusion

Using a Pocket Option robot strategy can provide traders with a competitive edge in the fast-paced world of online trading. By employing the right strategies and ensuring proper setup, you can enhance your trading performance significantly. Remember that while trading robots can simplify many aspects of trading, they must be approached with caution and proper understanding. Happy trading!