The Future of Forex: Exploring Automated Trading

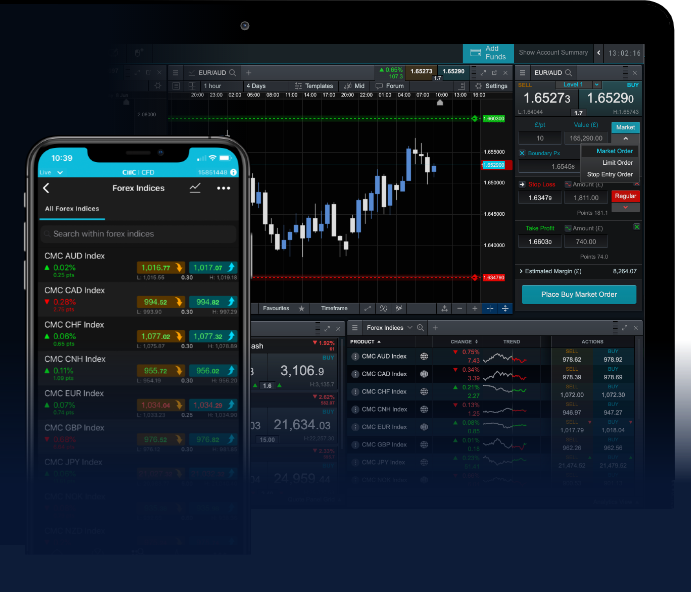

In recent years, the Forex trading landscape has seen significant advances, driven by technology and data analytics. One of the most intriguing developments in this domain is automated trading. This innovative approach leverages algorithms and software to execute trades at optimal times without the need for human intervention. As you delve into this guide, you will discover how automated trading is reshaping the Forex market and automated trading forex Online Trading CM can play a pivotal role in your trading journey.

What is Automated Trading?

Automated trading, also known as algorithmic trading or black-box trading, involves using computer programs to buy and sell currency pairs based on predefined criteria. These criteria can include price trends, technical indicators, and other market data. The primary goal of automated trading is to minimize human emotions, such as fear and greed, which can impact trading decisions.

Benefits of Automated Trading in Forex

The benefits of automated trading are numerous, making it an appealing option for both novice and experienced traders. Here are some key advantages:

- Speed and Efficiency: Automated systems can analyze vast amounts of market data and execute trades in milliseconds, far surpassing human capabilities.

- Consistency: Algorithms follow a set of rules and do not deviate from them, ensuring a consistent trading strategy that is not influenced by emotions.

- Backtesting: Traders can test their strategies on historical data to evaluate their effectiveness before deploying them in live markets.

- Diversification: Automated trading allows for the simultaneous management of multiple accounts and strategies, spreading risk across various assets.

How Automated Trading Works

At its core, automated trading relies on algorithms that generate trading signals based on market data. This process generally involves the following steps:

- Data Analysis: The system collects and analyzes market data, including current and historical prices, volumes, and economic indicators.

- Signal Generation: Based on the analysis, the algorithm generates buy or sell signals according to predefined trading criteria.

- Execution: The system automatically executes the trades on behalf of the trader, often using APIs provided by trading platforms.

- Monitoring: Most automated systems include monitoring features that allow traders to track performance and make adjustments as needed.

Key Strategies for Automated Trading

Implementing an effective automated trading strategy is crucial for success in the Forex market. Here are some popular strategies to consider:

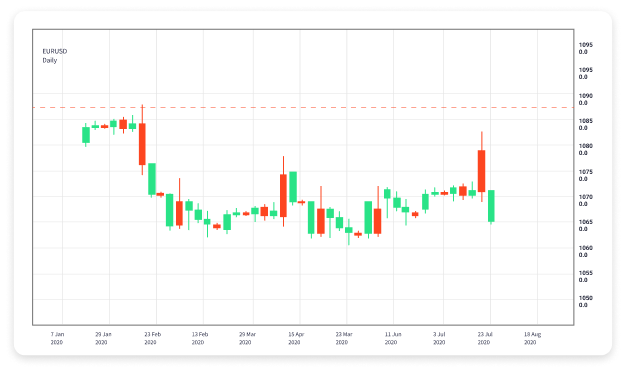

1. Trend Following

This strategy involves identifying and following market trends. An automated system might use indicators like moving averages or momentum oscillators to determine the direction of the market and execute trades accordingly.

2. Arbitrage

Arbitrage exploits price differences for the same currency pair on different platforms. Automated trading can rapidly execute trades to capitalize on these discrepancies, often resulting in small, quick profits.

3. Mean Reversion

This strategy is based on the assumption that prices will revert to their mean over time. Automated systems can help identify overbought or oversold conditions and execute trades when prices deviate significantly from historical averages.

4. Breakout Trading

Breakout trading focuses on identifying key price levels and executing trades when the price breaks through these levels. An automated system can monitor these levels continuously and act instantly when a breakout occurs.

Choosing the Right Automated Trading Software

With countless options available, selecting the right automated trading software can be daunting. Here are some factors to consider:

- User-Friendly Interface: Look for software with an intuitive UI that allows for easy navigation and quick setup.

- Compatibility: Ensure the platform is compatible with your broker and can execute trades seamlessly.

- Customizability: The ability to customize algorithms and strategies can be a game-changer, allowing you to tailor the software to your specific needs.

- Performance Metrics: Look for proven performance metrics, including historical returns and drawdown rates, to gauge the reliability of the software.

Risks Involved in Automated Trading

While automated trading offers numerous advantages, it is not without risks. Traders should be aware of the following:

- Technical Failures: System crashes or connectivity issues can lead to missed opportunities or unexpected losses.

- Market Volatility: Rapid market changes can impact the effectiveness of trading algorithms, leading to adverse outcomes.

- Over-Optimization: Traders may fall into the trap of over-optimizing their systems based on historical data, resulting in poor performance in live markets.

- Regulatory Risks: Automated trading strategies may face scrutiny from regulators, making it crucial to ensure compliance with relevant laws and regulations.

Conclusion

Automated trading represents a significant evolution in the Forex market, providing traders with tools and strategies that can enhance their trading experience. By understanding how automated trading works and the various strategies available, traders can harness this technology for improved outcomes. However, it is essential to approach automated trading with caution, being mindful of the associated risks and diligently monitoring system performance. With the right tools and strategies, the Forex market can become a new frontier for traders looking to capitalize on market opportunities with speed and efficiency.